Life Insurance in and around Columbia

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

Do you know what funerals cost these days? Most people aren't aware that the typical cost of a funeral in the U.S. is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If your family cannot manage that expense, they may fall into debt after your passing. With a life insurance policy from State Farm, your family can live comfortably, even without your income. Whether it pays for college, maintains a current standard of living or pays off debts, the life insurance you choose can be there when it’s needed most by your loved ones.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Wondering If You're Too Young For Life Insurance?

You’ll get that and more with State Farm life insurance. State Farm has fantastic protection plans to keep your family members safe with a policy that’s modified to align with your specific needs. Luckily you won’t have to figure that out alone. With personal attention and fantastic customer service, State Farm Agent Monica Markley walks you through every step to create a policy that safeguards your loved ones and everything you’ve planned for them.

State Farm offers a great option for anyone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can come in handy by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For more information, contact Monica Markley, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

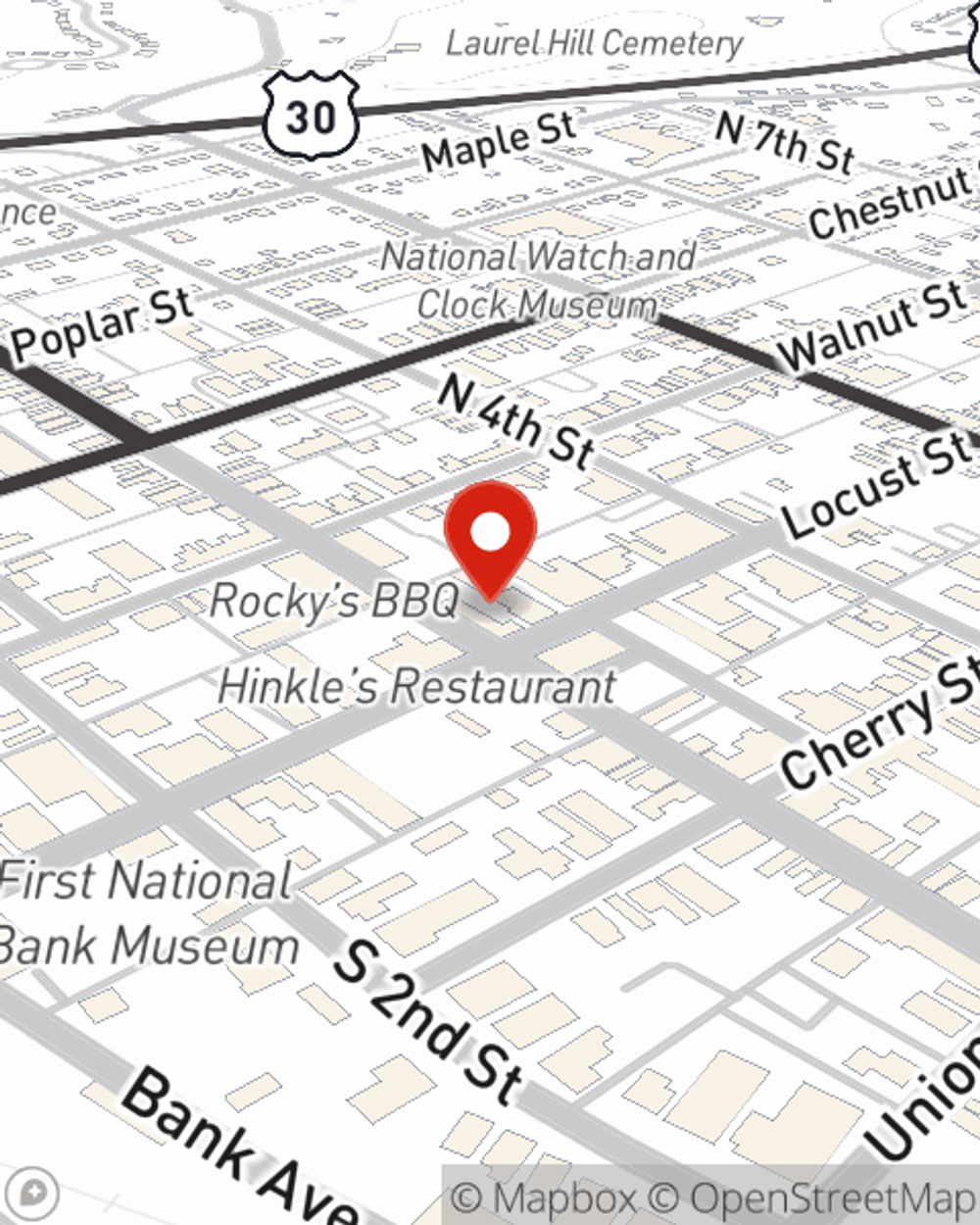

Call Monica at (717) 684-2144 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Monica Markley

State Farm® Insurance AgentSimple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.